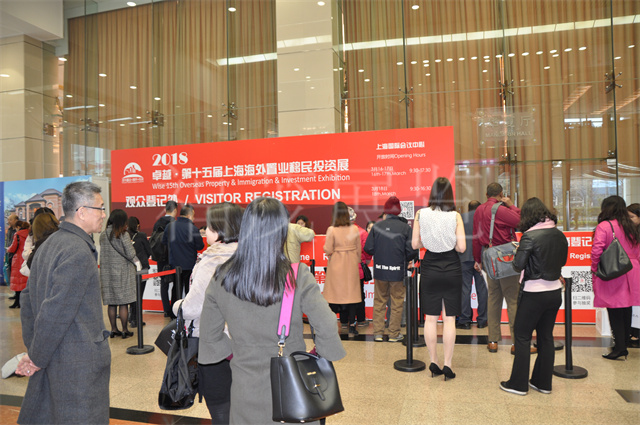

The 15th Wise Overseas Property & Immigration & Investment Exhibition (Wise 15th Overseas Property & Immigration & Investment Exhibition) grandly opened at the Shanghai World Expo Exhibition & Convention Center from March 16 to 18, 2018. As a benchmark exhibition in China’s overseas asset allocation sector, this year’s exhibition, themed “Opportunities and Choices in a Global Perspective,” brought together 195 leading companies from 40 countries and regions, attracting 35,285 professional visitors and high-net-worth individuals, of whom VIP visitors accounted for over 10%, setting a new record for industry exhibitions during the same period.

International Participation: 40 Countries Collaborate to Build a Global Resource Network

This year’s exhibition covered core regions including North America, Europe, Asia, and Oceania, with 40 participating countries. Traditional immigration and investment destinations such as the United States, Canada, Australia, the United Kingdom, Portugal, and Greece all made their presence felt. Emerging Southeast Asian markets like Thailand, Malaysia, and Singapore, as well as smaller European countries like Cyprus and Malta, also made their first-ever delegations. This diverse national presence not only provided investors with a one-stop solution for everything from real estate acquisition and immigration policies to education planning, but also highlighted the differentiated advantages of global asset allocation through the concentrated presentation of national pavilions.

Company Lineup: 195 Institutions Covering the Full Industry Chain

The 195 exhibitors encompassed overseas real estate developers, immigration service agencies, international schools, cross-border financial platforms, and legal consulting firms, forming a complete, closed-loop industry chain. The overseas real estate sector accounted for over 40%, including renowned international developers such as Lennar (US) and Meriton (Australia). The immigration services sector featured leading institutions such as Henry Immigration and Qiaowai Immigration. The education sector included study abroad service brands such as New Oriental Future Study Abroad and Qide Education. Furthermore, the exhibition launched its first “Cross-border Finance Zone,” inviting financial institutions such as HSBC and Bank of China to provide investors with value-added services such as overseas account opening and tax planning.

Visitor Data: 35,285 Professional Buyers, Targeted Matching of Needs

According to organizers, this year’s exhibition featured a demographic characterized by high net worth individuals and strong demand:

- VIP Visitors: Of the 35,285 attendees, over 60% were high net worth individuals with annual incomes exceeding 2 million yuan, 30% of whom already held overseas assets;

- Industry Distribution: 28% were employed in finance, 22% were business owners, and 15% were professionals in education;

- Decision-Making Ability: 78% of attendees indicated they planned to complete their overseas investment or immigration applications within six months, a 12 percentage point increase from the previous exhibition.

The exhibition utilized methods such as “appointment-based one-on-one meetings” and “project roadshows” to ensure in-depth connections between companies and target clients. The on-site signing rate reached a record high of 18%.

Core Content: Four Major Themes

- Overseas Real Estate: From Manhattan apartments to Phuket villas, exhibitors will showcase residential, commercial, and land investments, and will also feature a demonstration of blockchain-based real estate transactions.

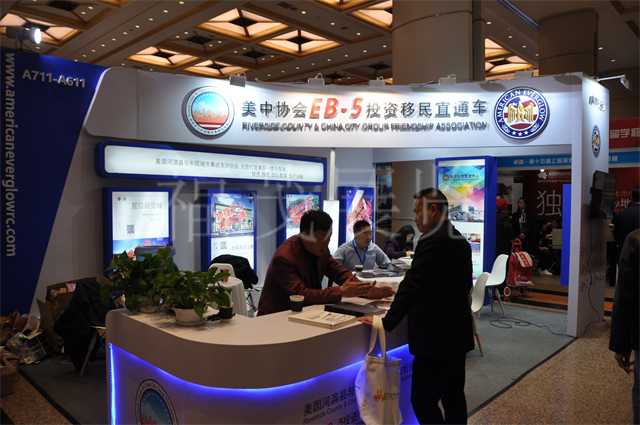

- Immigration Policy: A comprehensive overview of popular programs such as the new US EB-5 policy, Portugal’s Golden Visa, and Greece’s €250,000 home purchase immigration program will be available. On-site legal experts will provide policy risk assessments.

- International Education: Delegations from top high schools and universities from the UK, US, Canada, and Australia will be present, offering dual “study abroad + immigration” planning services and releasing the “2018 Global International School Rankings.”

- Cross-Border Investment: A focus on overseas funds, equity investments, and alternative asset allocation will be featured. HSBC will release its “Global Asset Allocation White Paper” and provide customized investment portfolio solutions on-site.

Industry Impact: Leading the Globalization of Chinese Capital

As a bellwether for China’s overseas asset allocation, the 15th Wise Expo not only provides investors with a platform to directly connect with global resources, but also promotes industry standardization through high-end events such as the “International Investment Summit” and “Immigration Policy Forum.” According to subsequent research, exhibitors received an average of over 200 potential clients, with 15% of these companies completing projects within three months of the exhibition. Furthermore, exhibition data was included in the “China Exhibition Economy Development Report (2019),” serving as a key case study for analyzing the globalization trends of Chinese capital.

The 2018 Wise Shanghai Exhibition, with its three core strengths of “scale, expertise, and precision,” solidified its position as a leader in China’s overseas asset allocation. Today, with the acceleration of globalization, the exhibition has become a crucial bridge connecting Chinese capital with global opportunities, continuously driving the global asset allocation process among China’s high-net-worth individuals.