These days, who doesn’t have a few friends who own property overseas? But there are many intricacies to overseas property investment. Today, we’ll discuss the most common pitfalls and the most successful methods for Chinese buyers.

Buying property directly is the easiest. In places like Australia and Canada, policies are more relaxed, and buying property there is no different from buying domestically – choosing a location, looking at the apartment layout, negotiating the price. However, be aware that some countries have restrictions on foreign buyers. For example, New Zealand requires an overseas buyer’s permit, and certain areas in Thailand only allow renting, not buying. This approach is suitable for families with spare cash who want to diversify their assets, such as buying a seaside villa for retirement or a school district property for their children – it’s quite reassuring.

Buying property with an immigration program is the most cost-effective. European “golden visa” countries, such as Greece and Portugal, offer residency status directly through property purchase. Spending €250,000 on an apartment in Athens’ old town allows you to collect rental income and obtain residency at the same time – essentially a “buy one, get one free” deal. However, it’s crucial to be aware of relevant policies. Some countries require properties to be held for a certain number of years before resale; otherwise, you might buy a property only to find the policy has changed, leaving you with no immigration status and stuck with losses.

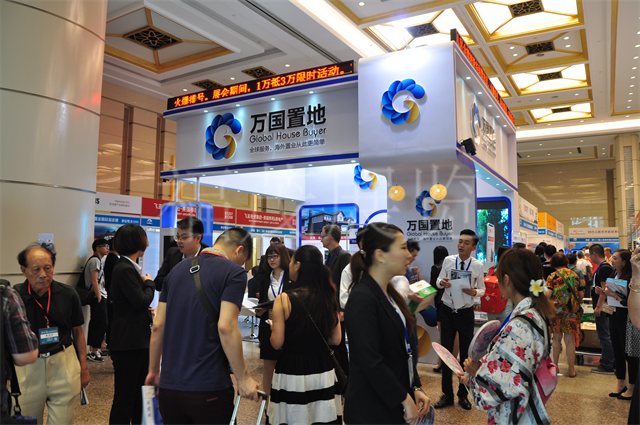

Buying property as part of a developer’s “group” is the easiest option. Many Chinese developers are now involved in overseas projects, such as in Bangkok and Kuala Lumpur in Southeast Asia, where there are often developments with “Chinese developers + local partners.” These properties usually come fully furnished and equipped with Chinese-speaking sales teams, ensuring smooth communication. However, be cautious—don’t just listen to sweet talk about “guaranteed rent” or “cash back”; check the developer’s reputation in the local market to avoid ending up with an unfinished project.

Partnering to buy property for investment is the riskiest approach. Some people pool their money to buy overseas shops or apartments, hoping to share costs and profits. For example, buying a small building in Japan to run a guesthouse, or buying student apartments in the US to rent out. This strategy can yield high returns, but it’s also very risky—partnerships are prone to conflict and management problems. You need a reliable third-party management company; otherwise, utility repairs and tenant disputes can be incredibly troublesome.

Buying in “potential” locations requires the best eye. Chinese homebuyers often prioritize tangible factors like “school districts” and “subways,” but overseas, “planning” is more important. For example, Dubai’s Future City and Singapore’s Jurong Lake District are key government-developed areas. They may look undeveloped now, but in a few years, with subway lines and shopping malls, property prices will skyrocket. However, thorough research is crucial; don’t be swayed by real estate agents’ “conceptual drawings.” Check government planning documents to ensure their accuracy.

Buying a property that can be rented out is the most practical approach. Whether for investment or personal use, overseas properties must be affordable to maintain. For instance, small apartments in Tokyo can yield 4%-5% rental returns; Australian villas can be rented out as weekend accommodations, earning several hundred Australian dollars per night during peak season. However, careful budgeting is essential—property taxes, management fees, and maintenance costs are hidden expenses; otherwise, the rental income might overwhelm the savings.

Ultimately, there’s no “best” way to buy property overseas, only the “most suitable” approach. Some seek residency, others prioritize returns, and still others simply value peace of mind. But whichever path you choose, you need to do your homework thoroughly—understand the policies, calculate the risks, and carefully read the contract. After all, our money doesn’t grow on trees, right?

Buying property overseas isn’t a “buy and sit back and make money” situation; you have to worry about it just like you would in China. But as long as you choose the right method, work with the right people, and do the math, the money will be well spent!