With the surge in global asset allocation demand, overseas investment has gradually moved from being exclusively for high-net-worth individuals to becoming a mainstream phenomenon. Whether it’s diversifying exchange rate risk, seeking higher returns, or paving the way for children’s education and retirement planning, the appeal of overseas investment is increasingly prominent. However, for beginners, language barriers, policy differences, and information asymmetry often become major obstacles. This article provides a systematic guide to overseas investment for beginners, covering cognitive preparation, risk assessment, path selection, and practical implementation, helping you steadily embark on your global wealth management journey.

The first step in overseas investment is to transcend the limitations of “domestic thinking” and establish a basic understanding of global markets. The operating logic of different economies differs significantly: the US stock market, dominated by institutional investors, has lower volatility but stable long-term returns, suitable for investors seeking steady growth; the Southeast Asian real estate market, due to demographic dividends and infrastructure upgrades, exhibits characteristics of “high rental yields but lower liquidity,” requiring investors to have a greater ability to select regions. Beginners should obtain information through authoritative channels, such as the central bank’s “Global Financial Markets Report,” the International Monetary Fund’s (IMF) economic outlook, or consult professional analyses from licensed financial institutions. A Shanghai investor, misled by claims of “20% annual property price increases in Thailand,” blindly purchased apartments in remote areas, only to find himself in dire straits due to low rent-to-price ratios and difficulty in reselling. This case serves as a stark warning: overseas investment must be data-driven, avoiding being misled by biased information or marketing rhetoric.

Risk assessment is a core aspect of overseas investment. The risks associated with overseas markets, such as exchange rate fluctuations, political instability, and legal differences, far exceed those in the domestic market. For example, the Turkish lira’s annual exchange rate volatility often exceeds 20%. Without hedging against exchange rate risk, even property appreciation could result in reduced real returns due to currency depreciation. Emerging markets like Brazil and Argentina may face asset security risks due to sudden policy changes. Newcomers should determine their risk tolerance through a “risk tolerance test”: those with low risk appetite can choose low-volatility assets such as USD deposits, gold ETFs, or developed market bonds; those who can tolerate some risk can consider US stock index funds or real estate in core cities; and those seeking high returns should carefully evaluate high-risk areas such as emerging market private equity and cryptocurrencies. A Beijing family achieved a balance between returns and risks by allocating 30% of their assets to US dollar bonds, 50% to US stock ETFs, and 20% to Singapore real estate, a strategy worth learning from.

The choice of investment path should follow a “gradual” principle. For beginners, it is recommended to start with “low-threshold, high-liquidity” assets and gradually accumulate experience. For example, investing indirectly in overseas stock markets through QDII funds requires no overseas account and can be done with a minimum investment of 100 yuan; or choosing compliant channels such as cross-border wealth management to purchase Hong Kong savings insurance, which combines protection and value appreciation. If interested in real estate, “real estate investment immigration” programs can be prioritized, such as the €250,000 commercial-to-residential conversion project in Greece, which grants Schengen citizenship and can cover part of the holding costs through rental income; the €350,000 fund investment project in Portugal is suitable for investors who wish to deeply integrate into the EU. After gaining experience, one can then expand to more complex areas such as private equity and overseas hedge funds. An investor in Guangzhou started with cross-border ETFs and, after three years, achieved a stable annualized return of 8% by participating in Singapore REITs projects; their approach is valuable for reference.

In the practical implementation phase, compliance is paramount. Chinese residents have an annual foreign exchange quota of $50,000; exceeding this limit requires gray-area methods like “ant-moving” (small-scale, piecemeal transactions), which may result in fines or even legal risks. Newcomers should prioritize compliant channels such as cross-border bank wealth management and QDII funds, or open overseas accounts through Hong Kong brokers. Tax planning is equally crucial: the US taxes global assets; holding US stocks or real estate requires filing an FBAR (Foreign Bank Account Report); Singapore, on the other hand, exempts overseas income from taxes, making it a suitable location for asset holdings. A Shenzhen investor suffered a severe tax penalty and was pursued by the US IRS for failing to report overseas accounts, a stark lesson. Therefore, utilizing professional institutions (such as licensed immigration consultants and tax advisors) to complete the compliance process is key to mitigating risk.

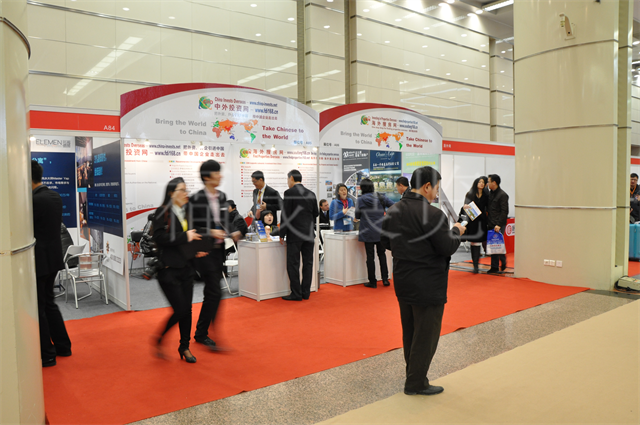

For beginners, overseas investment presents both opportunities and challenges. From upgrading understanding to risk management, from choosing a path to compliant operations, every step requires careful decision-making. The upcoming Shanghai Global Investment Expo will serve as a “one-stop platform” for beginners: the expo brings together financial institutions, real estate developers, and legal experts from over 50 countries worldwide, offering a full range of services from policy interpretation and project selection to tax planning. For example, World Trade Link Immigration will showcase exclusive projects such as Greek commercial-to-residential conversion and Portuguese fund investment, with a professional team to assist in avoiding property disputes; HSBC will provide on-site explanations of the latest policies for cross-border wealth management, helping investors optimize their asset allocation. By engaging face-to-face with leading industry institutions, beginners can quickly establish a global investment framework and avoid the “trial and error costs.” In today’s increasingly globalized world, taking the first step in overseas investment may be the key to opening a new chapter in wealth creation.