In discussions about investment and wealth management, the question of whether overseas real estate is more profitable remains a highly controversial topic. Some have doubled their assets through overseas property investment, while others have suffered heavy losses due to exchange rate fluctuations or policy changes. In reality, the potential returns and risks of overseas real estate investment go hand in hand. Its performance depends not only on the economic cycle and policy environment of the target market, but also on the investor’s risk tolerance and financial planning. Essentially, there is no absolute “more profitable” option; it’s simply a matter of whether it suits specific investment needs.

The profit advantages of overseas real estate often manifest in specific market environments. In some emerging economies, accelerated urbanization and the release of demographic dividends have led to sustained strong real estate demand. For example, in a Southeast Asian tourist city, over the past decade, due to improved infrastructure and increased international tourism, apartment prices have risen by an average of 10% annually, with rental yields remaining stable at 5%-7%, far exceeding most cities in China. In mature markets in Europe and America, property appreciation may be relatively slower, but stable cash flow can still be provided through rental income, tax benefits, and asset preservation. A British investor’s apartment in London, despite limited price increases, still yielded an annualized return of 8% through long-term rentals and tax deductions, becoming an important supplement to retirement funds. Exchange rate fluctuations are a double-edged sword for overseas real estate investment. When the currency of the investing country appreciates against the domestic currency, asset value and rental income increase simultaneously, creating a “double benefit.” For example, a Chinese investor who purchases property in Australia may see their assets appreciate by 10% against the RMB, even if the property price doesn’t increase, as the asset has already appreciated upon conversion back to the domestic currency. Conversely, if the currency of the investing country depreciates, it can erode actual returns. A Japanese investor who purchased property in the US experienced a 15% reduction in actual returns compared to expectations due to the depreciation of the US dollar, highlighting the importance of exchange rate risk management. Therefore, choosing markets with stable exchange rate trends or low correlation with the domestic currency is key to reducing risk.

Differences in policy environments directly impact investment returns. Some countries offer preferential mortgage policies, tax breaks, or freehold ownership to attract foreign investment. For example, Portugal’s “Golden Visa” program allows investors to obtain residency through property purchase while enjoying lower property transaction taxes; Thailand offers tax breaks for long-term rental properties, increasing net rental income. However, some countries impose restrictions on foreign property purchases, such as Canada’s additional taxes on foreign buyers and restrictions on non-resident property purchases in some Australian cities. These policies may increase investment costs or reduce liquidity. Therefore, a thorough understanding of the legal framework and policy orientation of the target market is a prerequisite for avoiding potential losses.

The liquidity risk of overseas real estate cannot be ignored. Compared to domestic real estate, overseas transactions involve language barriers, cultural differences, and legal procedures, and the selling cycle may be longer. For example, a US investor’s vacation villa in Brazil remained unsold for two years due to a sluggish market and a scarcity of buyers, eventually selling for 15% below market price. Furthermore, cross-border fund transfers may face foreign exchange controls or fees, further impacting actual returns. Therefore, overseas real estate is more suitable as a long-term asset allocation tool than a short-term speculative instrument.

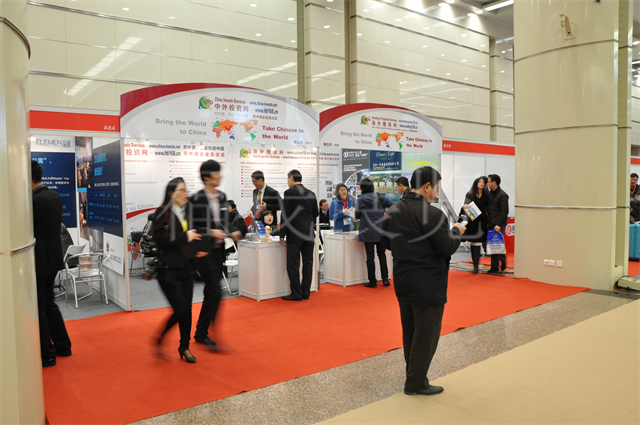

Whether overseas real estate is more profitable is inconclusive; its return potential depends on multiple factors, including market selection, exchange rate management, policy compatibility, and holding period. For investors seeking asset diversification and risk mitigation, overseas real estate can provide a source of returns with low correlation to the domestic market; however, for those lacking cross-border investment experience or with high liquidity needs, blindly following trends may lead to losses. Nowadays, various international investment expos often feature dedicated overseas real estate zones, bringing together high-quality global projects and professional advisors, providing investors with convenient channels for face-to-face consultations, project visits, and risk assessments. By participating in such activities, investors can gain a more systematic understanding of market dynamics and, in conjunction with their personal financial goals and risk appetite, formulate rational investment strategies. In the era of globalized asset allocation, understanding the logic and risks of overseas real estate investment and making good use of professional resources to assist decision-making are essential to seizing genuine wealth opportunities.