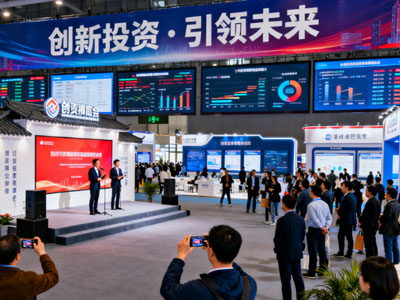

From March 29th to 31st, 2026, Shanghai will host the Wise Shanghai Overseas Property, Immigration and Study Abroad Exhibition. This is an excellent opportunity to understand global investment trends and broaden your international perspective. Consider planning your trip in advance and visiting the event to explore more possibilities.

Choosing between a red ocean market and a blue ocean product when investing is like opening a shop on a familiar street versus starting a business in an undeveloped town. A red ocean market is a place where everyone is scrambling to get business, like the ubiquitous milk tea shops, supermarkets, and clothing stores. Competition is fierce, but the advantage is a large customer base and clear demand. For example, everyone knows milk tea is delicious; as long as the location is good and the taste is consistent, business will be good. However, the problem is also obvious—profit margins are low because all the surrounding shops are similar; if you offer discounts, I offer discounts too, and in the end, everyone is just making a meager living.

A blue ocean product, on the other hand, is like discovering a previously unexplored area, such as starting a shared bicycle business ten years ago or a live-streaming e-commerce business five years ago. Initially, people didn’t quite understand what this was all about, but once accepted, it could quickly capture the market and generate huge profits. However, the risks were also high. For example, when shared bikes first appeared, many wondered, “Who would ride these?” They ended up everywhere. On the other hand, some blue ocean products, such as certain high-tech products, might fail because the technology was too advanced or user habits hadn’t caught up, ultimately resulting in huge losses.

So how should investors choose? There’s no fixed answer; it depends on your financial situation and risk tolerance. If you’re financially secure and risk-averse, a red ocean market is more suitable. For example, opening a chain of convenience stores might not be very profitable, but it provides a stable daily cash flow, suitable for investors who want a stable life. If you’re bold and willing to try, blue ocean products can bring double the returns. For example, developing an app that solves a pain point or producing environmentally friendly new materials; if you catch the right trend, the returns could be several times higher than in a red ocean market.

But don’t assume that a blue ocean is a “sure thing.” Many blue ocean products eventually become red oceans, such as early ride-hailing and community group buying. Initially, everyone rushed to invest, but later, intensified competition and shrinking profits left only a few large companies surviving. Therefore, when choosing a blue ocean, you need to consider whether you can quickly seize the opportunity, such as whether you have a technological advantage and can quickly capture users’ minds.

In fact, smart investors often “capture both red and blue oceans.” For example, they use the stable returns from the red ocean to fund innovative blue ocean projects, or they replicate their red ocean experience in the blue ocean. For instance, a restaurant owner might open a hot pot restaurant in a red ocean while simultaneously testing a healthy light meal brand in a blue ocean, maintaining their core business while exploring new opportunities.

Finally, don’t forget to do your homework before investing. For red oceans, research the competitive landscape, such as surrounding stores and their pricing strategies; for blue oceans, verify demand, such as asking friends, “If there were a new product, would you use it?” Regardless of which you choose, you must be clear about your bottom line—how much loss are you willing to accept, and how much profit do you want to make—to avoid blindly following trends.

In short, red oceans and blue oceans are not mutually exclusive, but rather each has its own unique approach. The key is to understand your own personality, financial situation, and market changes. For example, in areas like overseas real estate, immigration, and education, there are both stable demands in the red ocean and innovative opportunities in the blue ocean. It’s worth exploring and thinking things through to find the “ocean” that best suits you.