Against the backdrop of continuously upgrading global asset allocation, overseas real estate is becoming a key investment focus for high-end investors. At various real estate exhibitions and investment expos, overseas properties consistently occupy a central position, attracting a large number of investors with an international perspective. They are not only concerned with the price fluctuations of the property itself, but also with long-term returns, asset security, and the possibility of global expansion. So, why do high-end investors continue to favor overseas real estate? The underlying investment logic and trends are the focus of this article.

Overseas Real Estate Meets the Asset Allocation Needs of High-End Investors

For high-net-worth individuals, investing in overseas real estate is a systematic asset allocation strategy, rather than a single investment choice.

- Diversifying Single Market Risk

By allocating real estate assets in different countries and regions, the impact of regional economic fluctuations can be effectively reduced.

- Enhancing Asset Stability

Real estate in mature overseas markets has strong long-term holding attributes, meeting the needs of high-end investors for stable asset allocation.

- Physical Assets Offer Greater Security

Compared to financial products, real estate, as a physical asset that can be held for the long term, is more easily recognized by high-end individuals.

- Four Key Advantages: Clear Long-Term Value Preservation Potential

Properties in prime locations of high-quality overseas cities often possess clear long-term value support.

Comprehensive Advantages of Overseas Properties in terms of Returns and Planning

High-end investors value not only the property price itself but also the multiple added values it brings.

- Stable Rental Return Expectations

Long-term rental demand exists in some overseas markets, providing investors with a continuous cash flow.

- Balancing Self-Use and Investment Flexibility

Overseas properties can be rented out for income or used as living or family space in the future.

- Facilitating a Globalized Lifestyle

Overseas properties provide convenience for high-end individuals living, working, and traveling between different countries.

- Enhanced Asset Liquidity and Allocation Flexibility

In suitable market conditions, overseas properties offer excellent trading and exit opportunities.

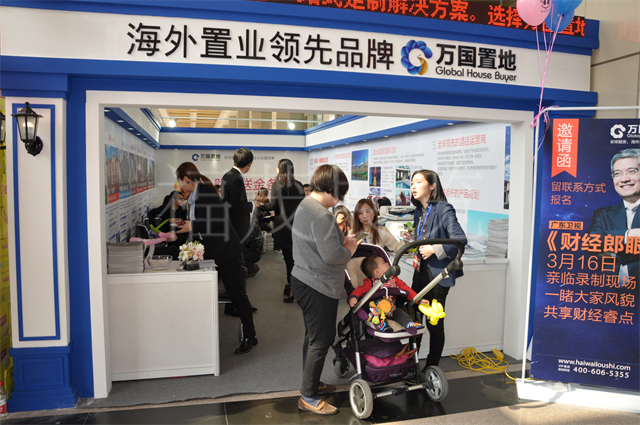

Real Estate Exhibitions and Investment Expos Promote Overseas Property Decisions

On professional platforms such as real estate exhibitions and investment expos, overseas properties are more easily understood and evaluated systematically.

- Centralized Showcase of Real Estate Projects from Multiple Countries:Investors can compare the characteristics and investment logic of properties in different countries and cities on a single platform.

- Professional Market Analysis:Through professional institutions and project developers at the exhibition, high-end investors can gain a more intuitive understanding of market trends.

- Reduced Information Asymmetry:Systematic presentations help investors establish a clearer basis for judgment before making decisions.

- Improved Investment Decision-Making Efficiency:Completing consultations and comparisons at investment expos better meets the efficiency requirements of high-end investors.

The continued popularity of overseas real estate among high-end investors is the result of multiple factors. From the security of asset allocation to the flexibility of returns and lifestyle planning, and the efficient information exchange platform provided by real estate exhibitions and investment expos, overseas real estate is becoming an important part of high-end investors’ global strategy. With the continuous development of international exchange and the investment environment, the value of overseas real estate in the eyes of high-end investors will continue to be strengthened.