With the increasing diversity of global investment opportunities, investment expos have become an important platform for investors to gather information and explore new ventures. These events bring together a wide range of domestic and international investment projects, allowing attendees to directly understand project features and communicate face-to-face with professional agencies and company representatives. This article highlights the most popular project types at investment expos and analyzes their characteristics and investment potential to help investors stay ahead of trends.

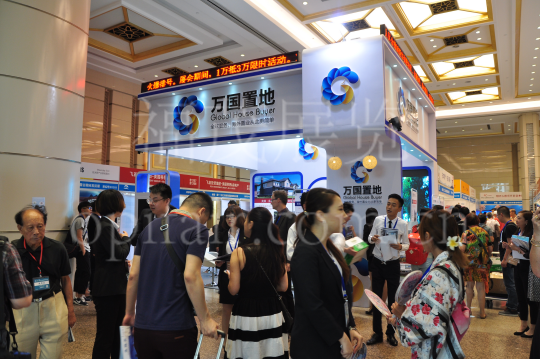

Real Estate Investment Projects

Real estate has long been one of the most popular segments at investment expos. Overseas property projects, in particular, attract significant attention from high-net-worth investors:

Stable Returns: Real estate in popular international cities usually offers stable returns, serving as a tool for wealth preservation and growth.

Investment-Immigration Opportunities: Some real estate projects are linked with investment immigration programs, such as the U.S. EB-5 or Portugal Golden Visa.

Project Diversity: From luxury residences to commercial real estate, hotels, and tourism properties, investors can select projects based on risk preference.

Equity and Startup Investment Projects

With the rise of entrepreneurship and innovation-driven economies, equity investment and venture capital projects have become expo highlights:

Early-Stage Startup Investment: Offers high growth potential but comes with higher risk.

Private Equity Funds: Suitable for conservative investors, these funds invest in multiple companies to diversify risk.

Innovative Sectors: Projects in AI, biotech, renewable energy, and other emerging industries align with future economic trends.

These projects not only focus on potential returns but also on the innovation and market potential of the project teams.

Financial and Wealth Management Products

Financial and wealth management projects are also popular at investment expos, especially for investors seeking stable returns:

Bonds and Fixed-Income Products: Low risk and stable returns make these options attractive to conservative investors.

Cross-Border Financial Products: Overseas funds and foreign currency asset allocation provide channels for international diversification.

Pension and Wealth Management Solutions: Comprehensive services targeting high-net-worth individuals are commonly showcased.

Cultural and Art Investment Projects

In recent years, cultural and art investments have emerged as a growing trend, attracting younger investors and collectors:

Art and Creative Investments: Includes paintings, sculptures, and digital collectibles (NFTs), offering both collectible and investment value.

Cultural Industry Projects: Such as film, music, and cultural tourism funds, aligned with the creative economy’s development.

While higher risk, these projects often generate significant attention and discussion at expos.

Practical Strategies for Selecting Expo Projects

With so many projects available, investors should use strategic approaches to select the right opportunities:

Define Investment Goals: Short-term returns, long-term growth, wealth preservation, or immigration-linked investments.

Assess Risk and Reward: Evaluate projects based on capital capacity and risk tolerance.

Check Credentials and Reputation: Choose projects with verified credentials, clear historical records, and good expo feedback.

Verify Information Across Channels: Gather comprehensive insights from official websites, professional media, and on-site consultation.

Conclusion

Overall, the most popular projects at investment expos include real estate, equity investments, financial products, and cultural/art ventures. Whether seeking stable returns or high-growth potential, attendees can access the latest investment information, engage directly with project representatives, and make informed decisions. Planning your expo visit strategically and clarifying investment objectives are key to maximizing the value of attending an investment expo.